When I started researching IREN 0.00%↑, the interviews done by McNallie Money with Dan were an amazing resource to know more about IREN 0.00%↑ and its leadership.

A couple days ago, a new interview was made based on Q3 2025 results.

Spoiler: Dan said much more than in the Earnings Call!

Highlights of Q3 Results

IREN 0.00%↑ achieved record revenues and EBITDA with an average operating EH/s slightly below 30. Right now IREN 0.00%↑is already at 40 EH/s and is expected to close June 2025 with 50 EH/s, which will keep improving results.

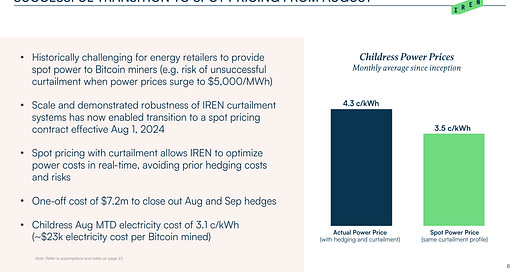

IREN 0.00%↑ had an all-in cash cost of $41k per BTC (vs. $93k revenue), explained by (a) best-in-class fleet efficiency, (b) low electricity costs (3.3 c/kWh), and (c) operating leverage with scale. IREN 0.00%↑ is the most efficient operator in the Bitcoin mining industry by far. While electricity costs are already fairly low, interestingly, Dan believes that IREN 0.00%↑ can still improve this cost in the short term. IREN 0.00%↑ hedges the market continuously (every 5 minutes) by trading the spot price dynamically (through algorithms) and optimizing electricity costs. This transition was done in August 2024. Also, as the 50 EH/s expansion is completed, Dan is expecting further improvements in efficiency as (a) latest generation hardware is installed and (b) more compute is installed at Childress, which has lower costs vs. British Columbia (mix shift). Last, but not least, Dan mentioned that IREN 0.00%↑ overprovisions slightly for installed capacity, having a buffer in what was ordered. Here's a reply from Dan regarding that exact matter:

Iren Cloud

Besides IREN 0.00%↑ having a 33% revenue growth quarter over quarter, there are a couple interesting remarks from Dan regarding this segment.

While there is an opportunity to scale the Cloud business, IREN 0.00%↑ is currently focused on the AI colocation opportunity of Horizon 1 and Sweetwater and Dan sees cloud as a segment that supports broader AI ambitions. IREN 0.00%↑ operates its own GPU cloud, which gives them hands-on knowledge on the matter. In Dan's opinion, this knowledge complements the AI colocation opportunity pipeline.

IREN 0.00%↑ potentially scaling GPU cloud will depend on risk-adjusted returns. According to Dan, IREN 0.00%↑ is currently negotiating GPU financing and working with customers in parallel. Dan also mentioned that they would love to do larger clusters.

Besides IREN 0.00%↑ operating its own GPU cloud, Dan highlighted that IREN 0.00%↑ is one of the few companies that can stand up capacity for additional cloud in 6-8 weeks since they got 47 MW available in Prince George (Canada). He also mentioned that in this existing data center cluster IREN 0.00%↑ operates B200 and B300 as they are starting to become available.

Finally, he mentioned that "the economics need to make a lot of sense as we are displacing capacity Bitcoin capacity to the extent we do this".

My main conclusion from Dan's comments is that IREN 0.00%↑ will not be scaling an "speculative" cloud segment with the strategy of buying the GPUs and finding a customer in the open market. In this regard, as Anthony said, the "non financial benefits of running [cloud] service are helping (...) in the strategy to be a colocator (...) for large clients". So, instead, IREN 0.00%↑ strategy is to focus on closing customers that demand GPUs (hopefully in large clusters) and then buying the GPUs and acting as their data center host, given they have already proven to the market they can operate GPUs.

While time will tell if this is the right strategy or not, I absolutely love the approach. With IREN 0.00%↑ being one step ahead on the value chain (not only supplying the data center racks, but also supplying the GPUs), the company will be able to capture a larger profit share AND de-risk the GPU financing risk since it will be tied to a customer contract. As Horizon 1 and Sweetwater come online, IREN 0.00%↑ will mix being a "shell"/rack space colocator and full GPU ready-to-use colocator.

Later in the call Dan mentions this:

"In the context of assessing different delivery models you might have a powered shell opportunity, where the CAPEX is lower, the notional return might be a bit lower but so is the risk; you may have a hyperscaler credit against it, the opportunity to put a high level of gearing. (...) Absolute dollars monetized per MW of power is obviously lower than turnkey full delivery and ownership of the data center, which is obviously lower again than if you are in the GPUs".

HPC AI Pivot (being the best Bitcoin miner)

Dan mentioned they can change this decision and refocus on Bitcoin mining. This meains this is a 2-way door and is always good to have a management that is open about changing direction if it is the right call. Regarding the decision itself, it was driven by IREN 0.00%↑ seeing very attractive opportunities on AI vs. keep expanding the Bitcoin business.

Dan also reflected on how the market is currently valuing the Bitcoin miners and said:

"If the cost of capital for Bitcoin mining is really high because the market isn't valuing it, then it doesn't matter how well Bitcoin mining is returning in absolute terms. (...) When you look at our market cap and sector wide and compare that to replacement cost or new build hardware, there's not an observable, material value uplift".

I believe this is a fair assessment of the current market conditions and, curiously (may be explained by the $1bn ATM?), despite being the most efficient Bitcoin miner in the industry, IREN 0.00%↑ has one of the cheapest valuations out there.

Finally on building the team for the HPC opportunity, Dan also said:

"(...) We've really controlled our corporate overheads over the last 12-24 months to create that broader profitability and this is why we we were so comfortable baking all of those costs (...) into our Bitcoin numbers. We can mine Bitcoin really profitably and have this free option very clearly on building out a big base and platform to launch the AI infrastructure".

This is underappreciated and shows both high quality stewardship and execution from IREN 0.00%↑.

Horizon 1

Active negotiations with multiple customers, not only for Horizon, but also for variations of design from turnkey to powered shells, encompassing both Childress as well as Sweetwater.

On Horizon specifically, Dan said:

"I am highly confident we're going to contract that prior to completion in Q4. We're at pretty advanced stages of diligence and commercial negotiations with parties. We got colocation full form agreements being circulated. Is a matter of moving through the process. These things may take a little bit longer than ideal, but it's just the nature. Don't forget that 50 MW of IT load support well over $1bn of computers. (...) There's very few sites in North America capable of delivering 20 MW plus of liquid cooled capacity this year and according to several prospects non that have then the expansion that we particularly got at Childress. A lot of these players (...) are pursuing this macro exponential trend that is unfolding and they are looking at growth: 'can you do 200, can you do 250? How quickly could you do that? Could we get options?' (...) We've got 2.9 GW. If it's all AI in 2-3 years time, then by definition is a good result because we're certainly not going to displace Bitcoin mining unless is clearly value accreative".

We didn't got the "it's binary mate" this time! Jokes aside: of course we will not get customer news in this forum, but I haven't seen Dan communicating this same message in a more bullish way ever before. I literally got heated up as Dan said this.

HPC at Childress

Dan mentions that IREN 0.00%↑ is able to implement an identical design of Horizon 1 by retrofitting the existing buildings at Childress. While starting from the scratch (Sweetwater) might be cleaner, Childress offers time advatanges given power is already online (only retrofit is needed). Dan also mentions that, depending on the customer nuances, either Sweetwater (2GW) or Childress (750MW) might be better suited. In the case of Sweetwater, given the expansion potential the site is better for a hyperscaler, with a single tenant model. In the case of Horizon, while there isn’t a single tenant demanding 750MW of power, the aggregate demand exceeds 750MW of power so the opportunity to develop a multi tenant colocation business exists.

Later in the interview Anthony asks Dan about the HPC mobilization timing. Regarding this point, Dan doesn’t give a definitive answer beyond saying that it depends on the individual conversations with each customer.

Dan also mentions that while IREN 0.00%↑ doesn’t advertise the pipeline (“until you get the contact is one and zero”), they are working to get more power online between Sweetwater (2026-2027) and 2030.

Sweetwater Hub, CAPEX & Funding, ATM usage

First of all, Dan is very clear saying that there is no intention of building data centers in Sweetwater without a client.

Additionally, Dan discussed the net CAPEX needs for 2025. IREN 0.00%↑ needs USD $250 million to complete the 50 EH/s expansion, Horizon 1 development, and site preparations works at Sweetwater (site grading, internal roads, substations, transformers, stepping down the high voltage power, among others to get the site ready for construction at a data center level).

Regarding funding, IREN 0.00%↑ informed in the earnings presentation they had USD $160 million of cash as of April 2025. The main 3 funding sources IREN 0.00%↑ is exploring are:

Convertibles market: IREN 0.00%↑ already knows this market and they closed a convertible debt in December. In this point, Dan also mentions that given the volatility over the last 6-8 weeks, he believes that given the terms the convertible debt market was offering, raising equity in parallel ($107.6M of the ATM was tapped at $6.18 during April) to buy IREN 0.00%↑ time to get to a better market was the right decision. Dan believes there could be an opportunity in here in the coming months and he mentions the market is already behaving different the past week.

Corporate bond: This is an structure they have been working with an advisor and Dan believes it has gotten to a point were they could go to market.

GPU financing: This source of financing will depend on finding good opportunities on the customer side, which is consistent with the cloud strategy described previously.

Regarding the equity raised over the period, Dan acknowledges that the equity raise wasn’t at a great price but also mentions that equity bought IREN 0.00%↑ time to get the company to the other side and close funding sources at better terms. He also mentions that another possibility IREN 0.00%↑ had was delaying Horizon 1. When I was aware of the dilution as the earnings call material was released, I would have loved that Dan or someone from IREN 0.00%↑ explained the reasons behind this in the way Dan did in the interview. Personally, I am glad they did not delay Horizon 1, given how important this asset is a the first real milestone of IREN 0.00%↑ entering in AI. On debt terms, I will trust Dan when he mentions that the terms were not right. With the benefit of time tapping the ATM clearly wasn’t a good call, but hearing Dan on the decision-making process gives me confidence on the process itself for making the right decision, which is what ultimately matters the most. Dan also says that in the case they funded the $250 million all-equity it would be a 10-12% dilution at current market price. In this sense, I wouldn’t disregard the possibility of IREN 0.00%↑ tapping the ATM again, yet if they do, I am assuming they only tap $250 million out of the remaining ~$780 million.

Last but not least, Dan said this regarding funding:

“I started infrastructure investment banking. I helped found an infrastructure funds management business which we grew to $6 billions of ports, airports, wind farms, solar farms, raising institutional capital unlisted, project financing. It is really, really, really clear: you get a customer contract, the capital flows. It is as simple as that”.

So, it can’t be any more clear. The moment IREN 0.00%↑ closes (and announces) the customer for Horizon 1, everything starts rolling.

Later in the call, Anthony asks Dan about potential HPC financing through customer prepayments. I like Dan answer in here, as he focuses instead on the credit worthiness of the counterparty instead of the preayment itself. He mentions the example of potentially having a binding contract with a hyperscaler. In this case, a prepayment probably does not make much sense since they can go to a debt provider with the contract. This shows consistency on Dan’s view regarding funding.

US Domestic Issues Status

Not much of an update in here besides reinforcing why it makes sense.

HODL Potential

Regarding this point, Dan refers again (as in past interviews) to the fact that as long as equity is being raised, if the company has a HODL strategy, what IREN 0.00%↑ would effectively be doing is issuing shares to buy Bitcoin. In the short term, we shouldn’t expect IREN 0.00%↑ to hold Bitcoin in treasury.

Conclusion

This was a fantastic interview. I loved it and I think that it has absolutely everything that the earnings call missed. Great job and hopefully we will keep getting this quarterly interviews for a while!

Interview:

I’ve been analyzing IREN’s expansion and financial metrics, and I’d love to get your insights on the following questions:

1️⃣ Mining Revenue & Costs

If IREN achieves 50 EH/s with 810 MW (660 MW + 150 MW expansion) and the network hash rate is 1,000 EH/s, they would mine approximately 8,350 BTC per year.

Estimated annual costs: $ 355M (Electricity: $235M Overhead + Energy Certificates: $120M)

2️⃣ Bitcoin Yield Per MW

Given 810 MW and 8,350 BTC per year, does the estimated yield of 10.48 BTC per MW per year seem reasonable?

If Bitcoin price = $100K, then 1 MW generates approximately $1M in revenue per year.

3️⃣ AI/HPC Data Center Classification

IREN’s 75MW AI/HPC data center is expected to cost $300M to build.

Given an estimated $4M per MW, would this classify as a Tier 2 (T2) data center?

Typically, Tier 3 (T3) facilities have higher redundancy & uptime guarantees, increasing costs. Does this align with industry pricing for Tier 2 facilities?

4️⃣ Expected AI Hosting Revenue Per MW

If IREN’s AI data center is Tier 2, expected revenue per MW should be $1.5M annually, based on comparisons to Core Scientific (CORZ), which earns $1.44M per MW from CoreWeave.

Does $1.5M per MW seem achievable in IREN’s AI colocation model or would it be higher?

5️⃣ Operating Costs Per MW for AI Data Center

what would be Estimated operating costs per MW per year:

Electricity: $30K per MW?

Cooling: $$50K per MW?

Maintenance: $15K–$25K per MW

Network & Connectivity: $10K–$30K per MW

Depreciation (Infrastructure): ?

6. How does IREN compare with CORZ in terms of AI//HPC. CORZ will have ARR of $360M (250 MW)starting from 2026 and $850M (590 MW) starting from 2027.