Paypal (PYPL) Q1 2025 Earnings Review

$PYPL Q1 2025 results reflect the company's current strategy. In an interview with Kross Roads, Alex, Paypal’s CEO said:

"I won't apologize from having price to value conversations. (...) We've been as transparent as we can in saying our revenues are absolutely slowing for a couple of quarters and then it will inflect and grow back. I would rather have the hard decisions and build the company for the long term (...)”.

In this sense:

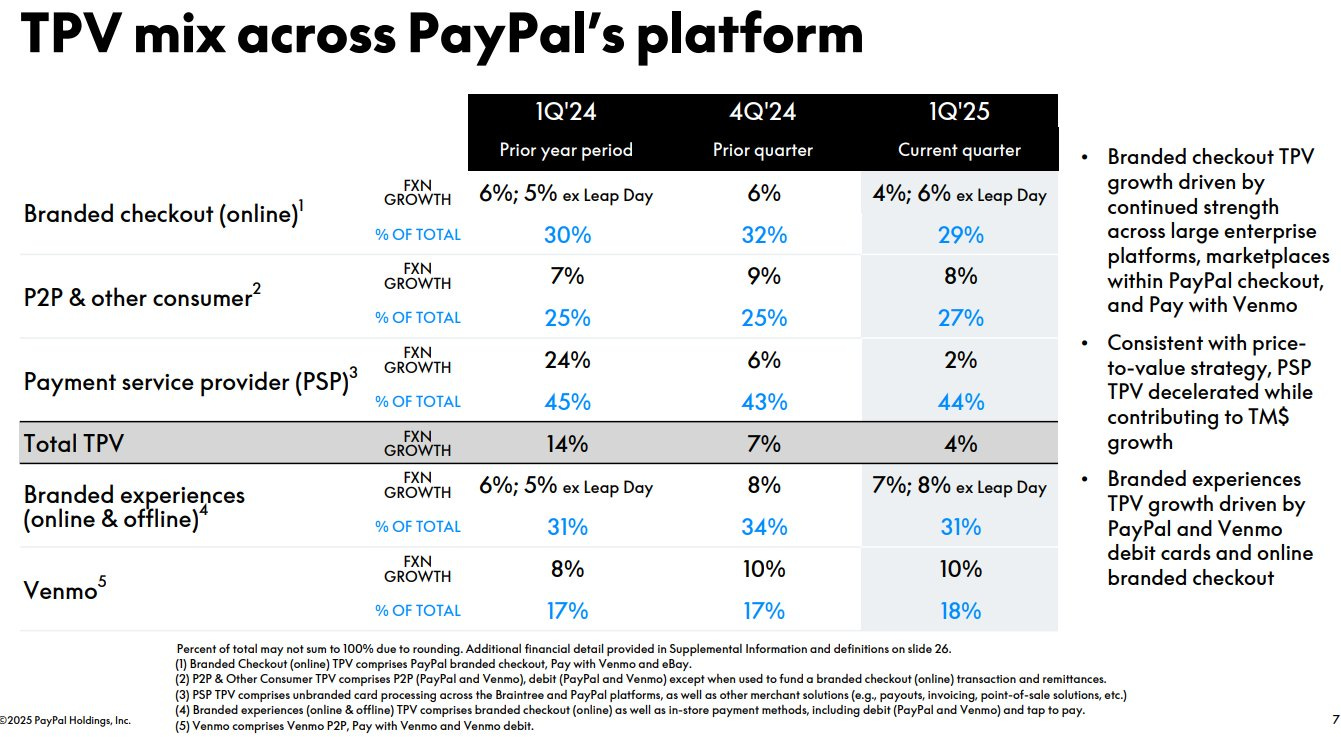

Revenues are slowing (+2% YoY FXN), driven by lower volume of payments transactions (-7% YoY). Excluding PSP, payments transactions grew +6% YoY.

As mentioned above, the decline in volume of payments transactions is driven by PSP (unbranded card processing, primarly Braintree). Revenues were growing last year +24% and are now growing +2%.

For Branded Checkout, P2P, Branded experiences, and Venmo growth is not slowing / accelerating slightly (.g. Venmo from +8% to +10%).

As a result, $PYPL continues to deliver Transaction Margin growth (+7%), which is the main driver of profitability of the company.

The guidance for 2025 of +5% to +7% TM Growth and $6-7bn Free Cash Flow ($6bn share repurchase) is maintained.

$1.5bn buybacks in Q1 2025.

I expect 2025 to be in this line. Paypal is focusing on branded experiences with better margins as a growth strategy. I wouldn't say this is a good quarter, but it is a quarter within the expectations of profitable growth and revenues growth slowing down before inflection.

[April 30th Update]

I just finished reading the transcript of Q1 2025 PYPL 0.00%↑ earnings call. Here are my takeaways!

1. Q1 Results Highlights

Transaction Margin grew +8% YoY excluding the impact from last year's leap day.

For branded experiences, TPV grew +8% YoY excluding leap day.

Total active accounts and monthly active acounts grew +2% in the quarter.

Venmo achieved 20% revenue growth. TPV increased more than 50%. Monthly active accounts grew 30%. Venmo debit card monthly active accounts grew nearly 40% and penetration has increased to 6% of Venmo monthly active accounts.

BNPL volume grew , +20% in Q1 and monthly active accounts +18% YoY, thanks to improvement on how BNPL is presented. BNPL users spend 33% more and conduct 17% more transactions.

Launch of the industry's first remote MCP server for agentic AI commerce.

"In the first quarter, users who adopted the PayPal debit card transacted nearly six times more and generated more than two times the average revenue per account compared to those who used online branded checkout only".

"Our omnichannel strategy is showing early success in the U.S. and we are excited to replicate it internationally".

Germany NFC in Q2, PayPal Everywhere in UK in Q3. As I mentioned before, PYPL 0.00%↑ is focusing on branded experiences with better margins as a growth strategy. I wouldn't say this is a great quarter, but it is a quarter within the expectations of profitable growth and revenues growth slowing down before inflection.

2. Price-to-value

"Recently we expanded our relationship with a long-time Braintree merchant. By focusing on price to value and processing, attachment of advanced risk capabilities and leading edge branded solutions like payment-ready API, (...) we took this merchant from unprofitable to profitable, improving their transaction margin nearly 20 percentage points over the course of a year".

Quite remarkable! Considering Braintree slowdown (from growing +24% YoY to grow +2% YoY), it will be very important to see the progress on this. Jamie Miller said:

"We are prioritizing healthy, quality growth within our Braintree business and have made deliberate choices to shift away from unprofitable volume. Shifting away from this volume pressures gross revenue but is accretive to transaction margin dollars and should result in more than one point of TM benefit this year. We continue to expect this benefit to build over time as we drive more value-added services".

In this sense, we know that the deacceleration in growth is a result of moving away from unprofitable growth, but, how should we expect Braintree volume to behave in 2025 for PYPL 0.00%↑?

3. China Tariffs

"(...) in the U.S., we are about 50/50 between retail and services (...). Our Chinese merchants selling into the U.S. is less than 2% of our branded checkout TPV, and this includes both direct China to U.S. cross-border transactions and volume from Chinese merchants with U.S. entities (...)".

While China to US corresponds to 2% of branded TPV, there might be second-order effects (e.g. US merchants that sell to US consumers on $PYPL retail imported from China). With that said, this is out of Paypal's control and is also difficult right now to predict how it will stabilize, so it is what it is.

The macro uncertainty is the main reason why $PYPL is not raising guidance despite having a strong Q1 from the Transaction Margin growth perspective. Jamie mentioned that consumer activity softening could cover 2-3 points of deacceleration in ecommerce trends in the second half of 2025.

4. Improved Branded Strategy and PayPal Everywhere

The branded strategy consists of 3 parts.

Branded checkout experience. US is already at 45% and roll out in Europe is starting (with Germany and UK) as mentioned above.

Accelerating Venmo, which as we saw on the highlights, had +20% revenue growth, +50% TPV and +30% monthly active accounts.

BNPL, in which TPV grew +20%.

PayPal Everywhere was launched in Q3 2024. Since then, there are 4 million new debit cards and TPV achieved 100% growth in Q1 2025. On the impact, this is what Alex says:

"(...) We’re starting to see that debit card users have a 5.5% to 6% lift in transaction activity and over 2x increase in average revenue per active user, versus just a checkout only. This is the strategy starting to take hold. This is a user that’s now becoming habituated with PayPal".

"We’re also starting to see the spend and the category demand actually extend to other categories outside, so we started with things I mentioned in the past - gas, groceries, restaurants, things that consumers have never used PayPal for before. Now, we’re starting to add new everyday spend categories like ride share and transit, so demand is really strong from these consumers. We’re starting to see the halo effect of not just offline but now moving into online, and again this is why this all comes back to this habituation and this branded experience journey that we think is going to work (...)".

Conclusion

With the risk of sounding repetitive, PYPL 0.00%↑ is executing what they said on the Investor Day. It can be slightly painful (e.g. revenues growth deacceleration driven by unbranded processing), but there are no surprises and results are looking promising so far.