Rakuten (TSE $4755): Deep Dive

I started researching Rakuten because I had the hunch is that the company could be potentially undervalued given that the financial statements mix (a) a bank consolidation, resulting in very high leverage, and (b) a loss generating business (Mobile), resulting in unattractive financial metrics. Let’s figure out I was right!

Origins

Rakuten Group, Inc., a major Japanese technology conglomerate, has its roots in the e-commerce boom of late 1990s. The business was founded by Hiroshi Mikitani on February 7, 1997, initially as MDM, Inc. Mikitani, who still leads the company as Chairman and CEO, holds 11.98% of the company. The flagship online shopping marketplace, Rakuten Ichiba, was officially launched on May 1, 1997. The company began its journey with a small team of just 6 employees and featured 13 merchants on its platform. In June 1999, the company officially changed its name to Rakuten, Inc. The name "Rakuten" is a Japanese word meaning "optimism," reflecting Mikitani's positive outlook on the future of internet-based commerce. A personal tragedy, the 1995 Kobe earthquake where Mikitani lost relatives and friends, reportedly influenced his decision to leave his banking career and start his own business, aiming to empower businesses and contribute to society.

Key Milestones

Rakuten's journey from a small online marketplace to a global technology giant has been marked by several transformative milestones:

Early Expansion and IPO (2000s):

Going Public: Rakuten went public through an IPO on the JASDAQ market in April 2000, which provided capital for expansion and increased brand visibility.

Service Diversification: The early 2000s saw Rakuten expand its services beyond a simple marketplace. Key launches included Rakuten Travel (online hotel reservations) in 2001 and Rakuten Books in 2001.

Loyalty Program: The introduction of the Rakuten Super Points loyalty program in November 2002 was a pivotal move, fostering customer retention and creating the foundation for the "Rakuten Ecosystem."

Entry into Financial Services: Rakuten significantly grew its financial services arm by acquiring Aozora Card Co., Ltd. (later Rakuten Card) in September 2004 and launching the Rakuten Card in 2005. This segment has become a major revenue driver. It later established Rakuten Bank.

The Rakuten Ecosystem and "Englishnization":

Ecosystem Strategy: A core element of Rakuten's growth has been the development of the "Rakuten Ecosystem." This strategy connects its diverse services (e-commerce, travel, finance, digital content, etc.) through a single membership ID and the Rakuten Super Points program, encouraging users to utilize multiple Rakuten services.

"Englishnization": In 2012, Rakuten adopted English as its official corporate language. This move, known as "Englishnization," aimed to accelerate global expansion, facilitate the integration of acquired international companies, and attract global talent.

Global Expansion through Acquisitions (Late 2000s - Present): Rakuten embarked on an aggressive international expansion strategy, primarily through acquiring established e-commerce and tech companies in various markets. Notable acquisitions include:

LinkShare (now Rakuten Advertising) in the U.S. (2005), marking its first major overseas acquisition.

Buy.com in the U.S. (2010, later rebranded Rakuten.com).

PriceMinister in France (e-commerce, 2010).

Kobo Inc. in Canada (e-book platform, 2012).

Viber (messaging app, 2014).

Ebates (cashback site, now Rakuten Rewards, 2014).

Venturing into New Industries (2010s - Present):

Telecommunications: Rakuten made a bold move into the mobile network operator business in Japan with the launch of Rakuten Mobile in 2020, aiming to disrupt the established market with innovative technology like Open RAN. After years of significant investment, Rakuten Mobile achieved monthly EBITDA profitability for the first time in December 2024 (still not profitable after including depreciation and amortization).

Digital Content and Streaming: Beyond Kobo, Rakuten expanded into digital content with services like Rakuten Viki and Rakuten TV.

Sports and Branding: Investments in sports teams like the Tohoku Rakuten Golden Eagles (baseball) and Vissel Kobe (football), along with major sponsorship deals (FC Barcelona, Golden State Warriors), have significantly boosted global brand recognition.

Significant Financial and User Milestones:

Rakuten achieved JPY 1T in annual revenue in 2018, 21 years after its founding.

It doubled this to JPY 2T in revenue by 2023, just five years later.

Rakuten has 44 million monthly active users and >1.5bn users registered in Viber.

Rakuten Card surpassed 30 million issued cards in 2023 and achieved over JPY 24T (USD $165bn) GTV.

Rakuten Bank surpassed 16 million customer accounts in 2024 and was listed on the Tokyo Stock Exchange Prime Market.

Rakuten Securities reached 11.9 million general securities accounts in 2024.

Rakuten Mobile reached 7.5 million subscribers in December 2024.

Focus on AI and Future Growth: Rakuten is increasingly focusing on leveraging Artificial Intelligence (AI) across its ecosystem to enhance services, improve operational efficiency, and deliver personalized experiences. This includes a strategic partnership with OpenAI.

Business Model, Industry and Competitive Advantage

Given the large range of businesses Rakuten operates, I decided to ask Gemini how would it summarize what Rakuten does in one sentence. Here’s the output:

“Rakuten is a global technology conglomerate that offers a diverse range of services centered around an "ecosystem" connecting e-commerce, fintech, digital content, and mobile communications, all linked by a unified membership and loyalty points program”.

I think that’s a great summary! However, the only caveat I would make is that, while Rakuten has global presence, Rakuten “ecosystem value proposition” is only available in Japan.

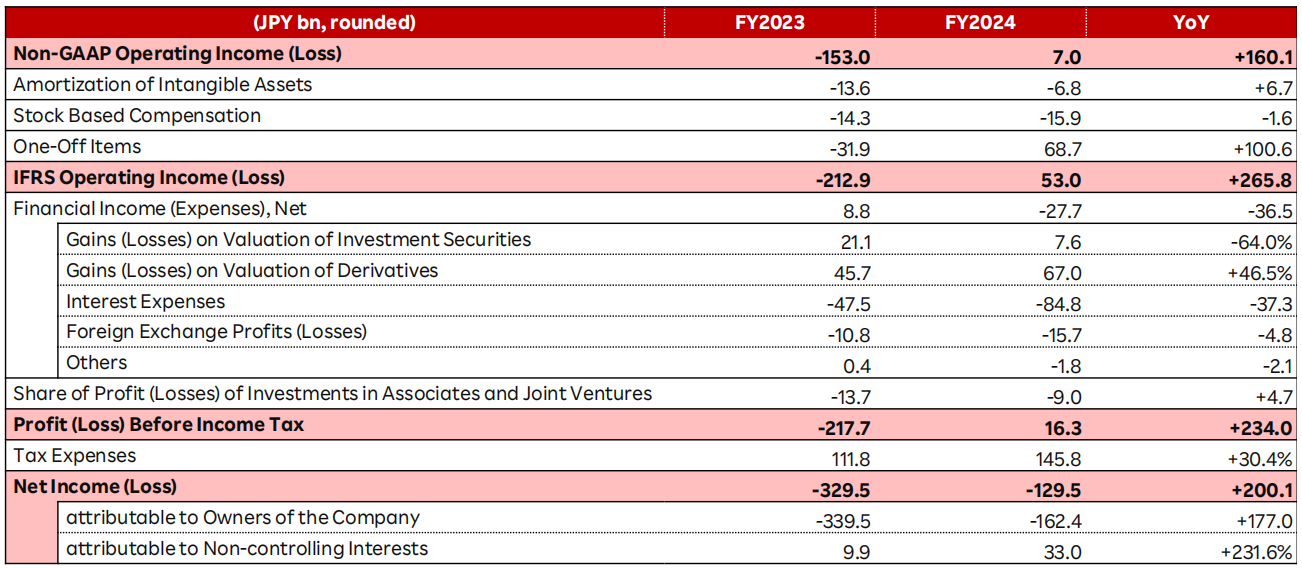

Rakuten has the remarkable track record of increasing revenues for 28 consecutive years. While this is truly remarkable and Mobile is still a small segment in the context of the complete company representing less than 20% of revenues, the expansion to Mobile and strong investment starting in 2019 generated strong challenges to Rakuten. Before 2019, Rakuten’s EBITDA was around JPY 150bn (USD $1.03bn) and operating income around JPY 100bn (USD $0.69bn). Since 2019, Rakuten has invested almost JPY 2T (USD $13.8bn) in Mobile, which is an industry that has significant economies of scale. This led to Rakuten becoming unprofitable since 2019 and demanded significant resources for funding, which led to the listing of some of Rakuten Bank and selling minority stakes in Rakuten Card and Rakuten Securities. Also, this led to the issuance of stock: Shares outstanding increased by 62% since 2019 to 2024. Ouch.

So, if Rakuten was a profitable business in 2018, why bothering on doing Mobile? The answer is that mobile is a significant driver of engagement for Rakuten Ecosystem. During 2024, Mobile represented 19% of revenues yet accounted for 34% of revenues growth thanks to the increased engagement in both Internet Services and FinTech. As shown below, Rakuten Mobile subscribers show between +15% to +47% higher usage of Rakuten’s verticals and increase at a higher pace the total verticals adopted, with a Mobile subscriber using 3.17 verticals on average vs. 0.74 for a non-subscriber. Establishing the foundations of Rakuten Mobile might have been painful, but it significantly strengthened the position of Rakuten. Also, through Open RAN and operations using AI and automation, Rakuten affirms they can achieve 40% lower CAPEX and 30% lower OPEX. The mix of (a) the ecosystem advantage and (b) lower costs allows Rakuten to have a competitive advantage over other companies in the telecom sector. For example, here is whar Mikitani said on the last call regarding the value offering of Rakuten Mobile for older people:

“Regarding older age groups, unfortunately, I will be turning 60 this year and entering that demographic myself. There are different perspectives on this. Some might say it’s great that we are capturing younger users. However, for those in their 60s, I suspect many are paying other carriers around 7,000 yen for only 3GB of data. We need to conduct a ground war to raise awareness among these individuals about how much they can save by switching to Rakuten Mobile.

Frankly speaking, I believe many of these people are overpaying. While this may be a revenue source for other carriers, we aim to operate fairly. We will communicate clearly that by switching to Rakuten Mobile, they can enjoy free calls, free SMS, 2GB of free data when traveling abroad, and unlimited usage for just 2,980 yen. We will work diligently to spread this message”.

While Rakuten Mobile seems like the right business decision, a 62% dilution is critical. So, what should we expect regarding Rakuten Mobile capital needs and future funding? I believe Rakuten will be able to self-fund CAPEX moving forward. Here are the main reasons why:

While mobile network required between JPY 250-300bn during its early years, right now the foundation is already established and CAPEX demand is between JPY 150-200bn. Later in this article I will discuss more on Mobile CAPEX.

Rakuten Mobile achieved monthly EBITDA profitability in December 2024 and the objective for 2025 is that this segment is EBITDA profitable. In 2024, Rakuten Mobile generated an EBITDA loss of JPY -111bn (USD $0.77bn), so getting this back to the P&L is a huge tailwind.

On 2024 Rakuten was already able to self-finance investment. It is important to mention though that this included JPY 170bn (USD $1.17bn) from mobile sale & leaseback proceeds, which is a one-off.

Internet Services and FinTech had strong performance in 2024 and they should keep improving in 2025, being a further lever of cash generation.

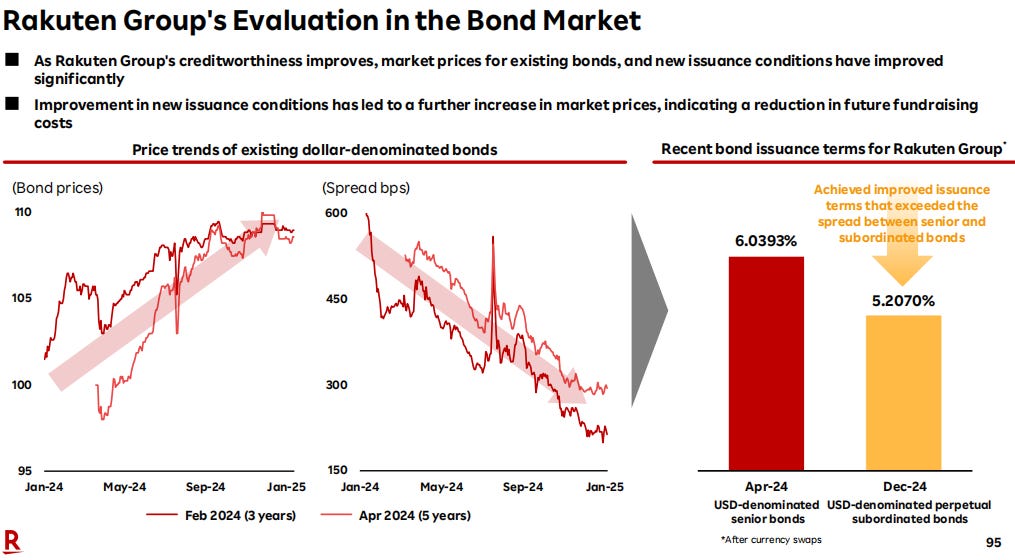

Thanks to Rakuten’s financial impovement, the company is now having better debt terms. The spreads of existing USD bonds have reduced 200-400 bps and in December 2024 the company issued a 5.2% perpetual bond (USD), compared to a 6.0% senior bond issued in April of the same year.

Financials and Valuation

While there are obvious synergies between segments as discussed before, I will be addressing the valuation of Rakuten with a Sum of The Parts approach.

Internet Services Segment

Internet Services is made up by Domestic segment, International segment, Minority Investments, and Other Internet Services.

Domestic Segment

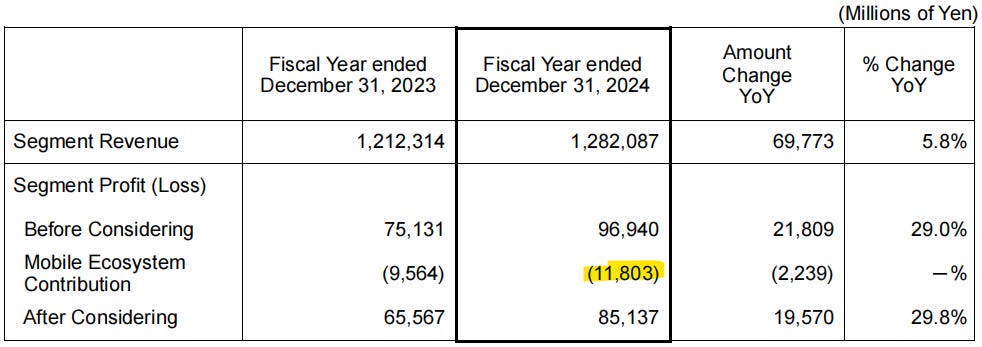

The Domestic Segment is the evolution of the legacy Rakuten Ichiba original business, which has now evolved beyond e-commerce and include other core businesses such as Travel, and growth businesses (that are not necessarily profitable right now) such as logistics or mart, which is conformed by 9 JP Rakuten logistics centers and 3 Rakuten Mart logistic centers. Rakuten is the “Amazon of Japan” when we are discussing e-commerce. An absolute leader.

In 2024 Domestic E-Commerce achieved JPY 5.96T GMS (USD $41.4bn), having a -1.5% YoY growth. The negative growth is explained by temporary factors and, excluding those, GMS growth was +4.6% YoY. Regardless, Domestic E-Commerce is a stable business segment growing below +5%. Despite the negative growth in GMS, E-Commerce Revenue corresponded to JPY 923bn (USD $6.4bn) and grew +4.2% YoY, mainly thanks to a +0.9% increase in take rate driven by ads (from 14.6% to 15.5%). As a result, operating income for 2024 corresponded to JPY 107bn (USD $0.74bn) and grew +4.6% YoY. While the company accelerated growth in Q4 2024 (+9.5% YoY GMS, +10.0% YoY revenues, +19.7% YoY operating income), I will assume this segment is stable and grows around +3% to +5%. For this growth, I think an operating income multiple around 12x is reasonable. As a result, the value of the Domestic E-Commerce segment is JPY 1.28T (USD $8.9bn).

International Business Unit Segment

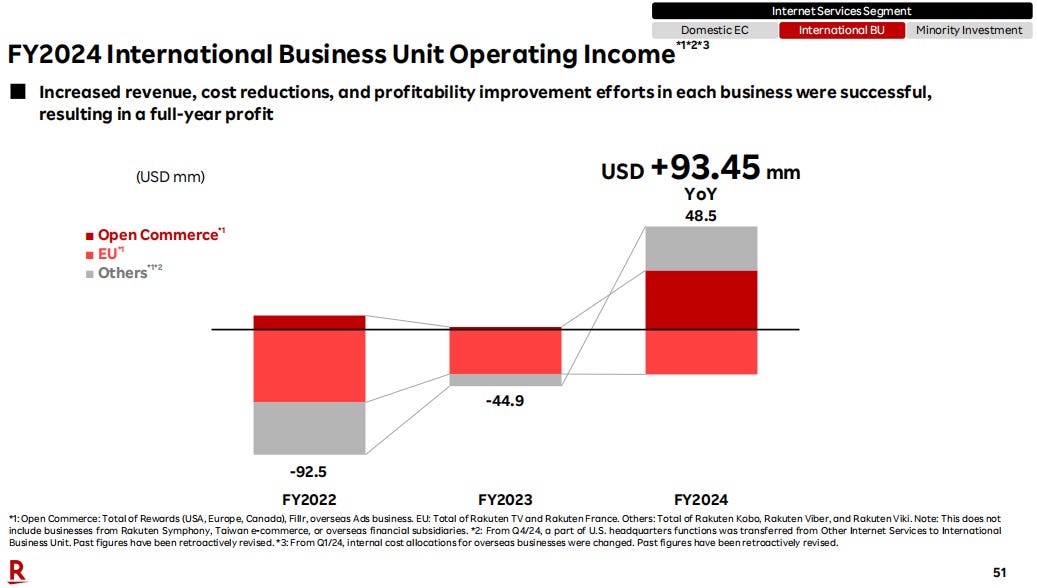

In 2024 the International Business Unit segment achieved USD $2.04bn (JPY 294bn) revenues, growing +8.5% YoY. After being unprofitable for several years, in 2024 the International Business Unit achieved a USD $49M (JPY 7bn) operating income, which corresponds to a 2.4% operating margin. The International Business Unit is further divided in 3 categories:

Others: Fastest growing segment, profitable.

Rakuten Kobo: ebooks and audiobooks. Currently has 69.3 million registred users (+7.1% YoY). Acquired by Rakuten in 2012 for USD $315 million.

Rakuten Viber: cross-platform voice over IP (VoIP) and instant messaging (IM) software application. Currently has 1.57bn users registered (+4.9% YoY). Acquired by Rakuten in 2014 for USD $900 million.

Rakuten Viki: over-the-top subscription video on-demand streaming service. Currently has 99 million users registered (+20.2% YoY). Acquired by Rakuten in 2013 for USD $200 million.

EU: Smaller segment (from a revenues point of view), unprofitable.

Rakuten TV: video-on-demand and free ad-supported streaming television platform. Currently has 132.5 million registred users (+41.2% YoY). Acquired by Rakuten in 2012, no disclosed amount.

Rakuten France: French e-commerce company. Acquired by Rakuten in 2010 for EUR $200 million.

Open Commerce: largest segment, stable, profitable.

Rewards and Oversea Ads: cash-back and shopping rewards company. Rakuten Rewards has a USD $12.25bn GMS (+1.9% YoY). Acquired by Rakuten in 2014 for USD $952 million.

Rakuten has invested over USD $2.5bn in acquisitions for the International Business Unit. The list from above is not exhaustive (e.g. Buy.com was acquired for USD $250 million in 2010). While it is hard to predict how this will eventually turn out, I think we can say that Rakuten likely overpaid for some of these companies since most acquisitions were done over 10 years ago and there isn’t a clear picture of success. Also, I don’t see any particular name that really excites me. For example, Rakuten TV and Rakuten Viki, the fastest growing of all, compete with behemoths such as YouTube or Netflix, which are in a different league. I do want to mention that Rakuten may have an interesting plan for this segment. In the last earnings call, Mikitani, Rakuten CEO, mentioned:

“As an ecosystem, Rakuten Group is generating significant profits through services like Rakuten Viber, Rakuten Kobo, and Rakuten Viki. While these are currently individual points, we aim to connect them into a network and monetize our membership-based business model overseas. This is a unique model that differs from those of hyperscalers like Google, Amazon, Meta, Apple, and Microsoft, and I believe it still has potential”.

For the valuation, I will assume this segment can grow around +5% to +10% (both revenues and operating income). While current operating margin is low and can definitely improve, I will just be conservative and assume same growth as revenues since I don’t see any specific MOAT or advantage (yet). For this growth, I think a 15x multiple could make sense. As a result, the valuation for the International Business Unit would correspond to USD $0.73bn (JPY 105bn). This is probably around 20% of the total spend in acquisitions.

Minority Investments

Rakuten has invested JPY 156bn (2012-2024) with a 17% IRR. Currently, Rakuten has JPY 89bn (USD $0.62bn) of unrealized investments. Rakuten holds a 13.1% stake in AST SpaceMobile, Inc ($ASTS) which is worth $725 million at the moment I am writing. This stake is recognized as part of the Mobile Segment.

Other Internet Services

Finally, Other Internet Services is made up by Rakuten TV Japan and Rakuten NFT. This segment has JPY 76.4bn (USD $0.53bn) revenues and JPY -26.9bn (USD -$0.19bn) losses. Of the losses, almost JPY -12bn can be attributed to the Mobile Ecosystem. Since this is a losing segment, I will write it off for now and assign no value.

Internet Services Segment Recap

(+) Domestic EC: JPY 1.28T (USD $8.9bn)

(+) International Business Unit: JPY 105bn (USD $0.73bn)

(+) Minority Investments: JPY 89bn (USD $0.62bn)

(+) Other Internet Services: n/a

(=) Assets: JPY 1.47t (USD $10.2bn)

FinTech Segment

Considering Rakuten has different ownership stakes for the different corporations that make up the FinTech Segment, we will make an individual valuation for each.

Rakuten Bank

Rakuten Bank was listed on April 2023 for JPY 1,400 per share, disposing 36.7% of the business for a total of JPY 75.5bn. Additionally, 8 months in December 2023 the company disposed an additional 14.1% fot JPY 2,470 per share, raising a total of JPY 60.6bn. Currently, Rakuten Bank share price corresponds to JPY 5,075 and has market capitalization of JPY 1.03T (USD $7.15bn). Rakuten’s 49.27% stake in Rakuten Bank is worth JPY 507bn (USD $3.52bn). The returns for the investors that invested in Rakuten Bank have been amazing, which also raises the question of Rakuten Bank potentially having being listed for a price deemed to be to low as the CAPEX needs from Rakuten Mobile were pressing. However, having Rakuten Bank as an independent company also contributes to price discovery of the business itself.

Rakuten Bank ends its fiscal year in March, so we don’t have full 2024 fiscal year results yet. However, on the 9 months of 2024 fiscal year the bank had 16.4M accounts (+11.6% YoY), with 32.6% of those being the main account, and 16.8% ROE. Also, for the last 12 months net income corresponds to JPY 44.5bn and has a 25% CAGR since 2021. Based on current valuation and income Rakuten Bank trades at 19.9x P/E and 3.0 P/B. Rakuten Bank pays no dividend. This valuation is demanding and sustaining it will depend on Rakuten Bank to keep delivering growth.

Offering in April 2023

Offering in December 2023

Rakuten Card

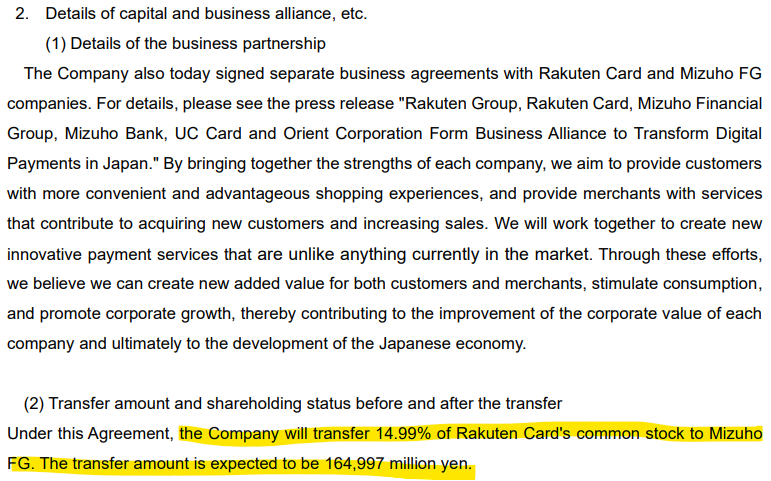

On November 2024, Rakuten sold a 14.99% stake of Rakuten Card to Mizuho Financial Group for JPY 165bn (USD $1.15bn), which values 100% of Rakuten Card business for JPY 1.10 trillion (USD $7.64bn) and Rakuten’s 85.01% stake in Rakuten Card in JPY 935bn (USD $6.49bn).

On 2024 Rakuten Card had JPY 24.0T GTV (+13.7% YoY), JPY 340bn revenues (+7.3% YoY), and JPY 62bn Operating Income (+20.4% YoY). Rakuten Card is still growing rapidly and thanks to its scale, the segment is gaining operating leverage, improving its operating margin from 14.2% in 2021 to current 18.3%. The results from 2024 value Rakuten Card at 17.7x Operating Income, which seems reasonable considering the business is growing GTV at double-digit and operating income faster considering operating leverage.

Rakuten Securities

Rakuten currently holds a 51% in Rakuten Securities, after selling a 19.99% stake in November 2022 for JPY 80bn (JPY 400bn valuation) and a 29.00% stake in December 2023 for JPY 83bn (JPY 300bn valuation) to Mizuho Securities, as part of the strategic alliance which is also reflected in the ownership of Mizuho Securities in Rakuten Card.

For 2024, Rakuten Securities had 11.9M accounts (+17.0% YoY), JPY 130bn revenues (+17.1% YoY), and 33.6bn (+11.1%) operating income. Based on the past metrics, Rakuten Securities was valued at:

2022 (JPY 400bn valuation): JPY 95.8bn revenues (4.2x) and JPY 18.7bn operating income (21.4x).

2023 (JPY 300bn valuation): JPY 111.3bn revenues (2.7x) and JPY 30.2bn operating income (10.0x).

Considering Rakuten Securities is growing accounts, revenues and operating income at a healthy double-digit rate, I think a reasonable valuation for the business is 15x operating income. This will value Rakuten Securities in JPY 504bn (USD $3.5bn) and Rakuten’s 51% stake in JPY 255bn (USD $1.77bn).

Transfer of 19.99% of Rakuten Securities to Mizuho Securities in November 2022

Transfer of 29.0007% of Rakuten Securities to Mizuho Securities in December 2023

Rakuten Payment

95.3% of Rakuten Payment is held by Rakuten Card and 4.7% by Rakuten Bank. Since this business is smaller in comparison to the rest of the FinTech segment and the value of Rakuten Payment already recognized in Rakuten Card and Rakuten Bank valuations, so we will ignore this.

Rakuten Insurance

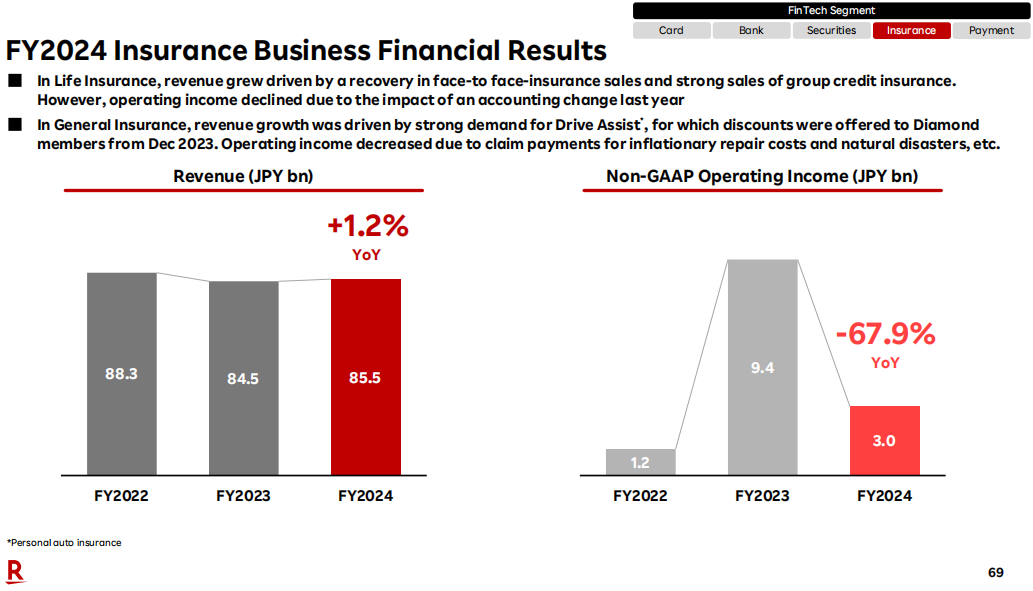

Rakuten Insurance is 100% held by Rakuten. This busisiness segment had declining sales from 2022 to 2023 and +1.2% in 2024, achieving JPY 85.5bn. Regarding operating income, operating margin has fluctuated over the years from 1.4% in 2022, 11.1% in 2023, and 3.5% in 2024.

This business is smaller in comparison to the rest, so I will not take too much time in figuring out how much it could be worth. Assuming flat revenues and operating income, an operating income multiple of 6-7x could be reasonable. Hence, I will assume Rakuten Insurance is worth JPY 20bn (USD $0.14bn).

Others

Finally, Others is made up by Rakuten Securities Holding, Rakuten Wallet, Rakuten Investment Management, among others. This segment has JPY 17.3bn (USD $0.12bn) revenues and JPY -17.0bn (USD -$0.12bn) losses. Of the losses, almost JPY -15bn can be attributed to the Mobile Ecosystem. Since this is a losing segment, I will write it off for now and assign no value.

FinTech Segment Recap

(+) 49.27% stake in Rakuten Bank: JPY 507bn (USD $3.52bn)

(+) 85.01% stake in Rakuten Card: JPY 935bn (USD $6.49bn)

(+) 51% stake in Rakuten Securities: JPY 255bn (USD $1.77bn)

(+) Rakuten Payment: n/a

(+) Rakuten Insurance: JPY 20bn (USD $0.14bn)

(+) Others: n/a

(=) Assets: JPY 1.72T (USD $11.9bn)

Mobile Segment

Mobile is made up by Rakuten Mobile, Rakuten Symphony, Rakuten Energy, and Others.

Before jumping into mobile segment, this is a good time to discuss CAPEX. Since 2019, Rakuten started investing aggressively in both Property, Plant & Equipment and Intangible Assets with the objective of establishing a foundation to become the #1 mobile carrier in Japan. While Rakuten invested less than JPY 10bn in 2018, in the period of 2019-2024 Rakuten Mobile invested over JPY 1.8T (USD $12.64bn), starting formally the mobile business with paying subscribers in 2021 and achieving over 96% 4G population coverage in 2022. During 2024 CAPEX for Rakuten Mobile segment already slowed down. While CAPEX exclusively focused on improving Network Quality corresponded to JPY 250-293bn between 2020 and 2022, in 2023 it decreased to JPY 168bn and in 2024 to JPY 81bn. For 2025, Rakuten is expecting to invest JPY 150bn (USD $1.03bn).

Rakuten Mobile

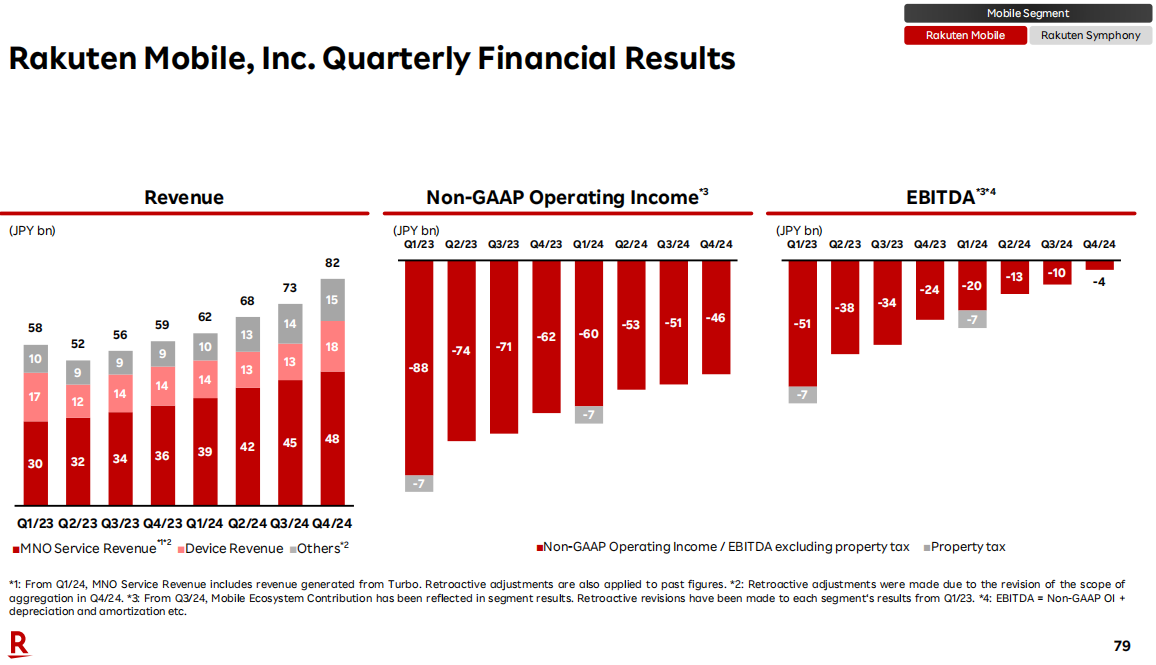

Rakuten Mobile is currently unprofitable, generating JPY -243bn (USD -$1.68bn) operating losses and JPY -80bn (USD -$0.55bn) EBITDA. However, the profitability of Rakuten Mobile has been improving over time. Regarding EBITDA, which excludes depreciation and amortization (significant for Rakuten Mobile), just 2 years ago Rakuten was generating JPY -325bn (USD -$2.24bn) and in December 2024, for the first time in Rakuten Mobile history, profitability was achieved with JPY 2.3bn (USD $16M) EBITDA. While December has a positive impact from year-end season sales, Rakuten has the goal of achieving full-year EBITDA profitability for Rakuten Mobile on a standalone basis.

From a revenues point of view, Rakuten Mobile achieved JPY 284bn revenues (USD $1.96bn), +26% YoY, driven by an increase in MNO Subscribers from 5.90M to 7.46M (+26.4%) and flattish ARPU (gross JPY 2,918 to JPY 2,856, net JPY 2,350 to JPY 2,408). Notably, churn has been improving over time, though Q4 2024 particularly saw a churn increase from 1.12% to 1.38%. Rakuten’s goal for 2025 is to achieve 10 million subscribers.

As mentioned before, Rakuten holds a 13.1% stake in AST SpaceMobile, Inc ($ASTS) which is worth $725 million at the moment I am writing. What makes ASTS particularly special and unique is that it offers broadband direct-to-mobile communication with satelites. Regarding this investment, Mikitani, Rakuten’s CEO said in the last earnings call:

(…) we took on the initial startup risk, and we have an arrangement where Rakuten Mobile can utilize it without requiring significant additional investment or costs. Therefore, no major additional investment or expenses are expected for AST”.

The main reason Rakuten Mobile has generated huge operating losses is that the Mobile business requires significant economies of scale and has large fixed costs. For example, despite growing from 4.56M to 7.46M subscribers in the last 2 years, the quarterly operating cost has been flat, with a decrease in the first couple quarters explained by a lower use of roaming services which are very expensive. As the business keeps growing Rakuten will need to keep investing, but the company will also strengthen its position as it does and users will increase data consumption. In words of Mikitani:

“(…) as user data consumption increases, we need to make further investments, particularly in 5G, to enhance network quality. While we rarely hear complaints about network quality anymore, and most users are satisfied, the increasing data usage necessitates additional investments in 5G.

As the number of users grows, we also need to strengthen the core network. Conversely, investing in these areas will allow us to further reduce future roaming costs. I believe this is a positive correlation, where investments in network quality will lead to cost savings in the long run.”

Rakuten Symphony, Energy, Others

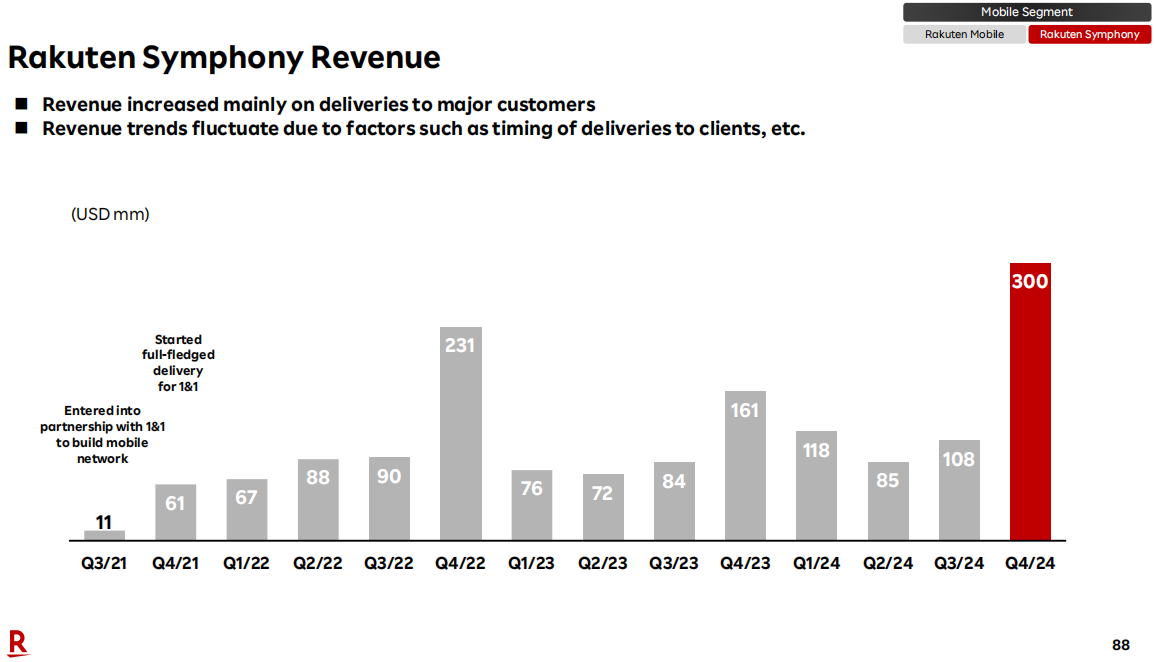

In August 2021 Rakuten announced that Rakuten USA agreed to acquire Altiostar, “which provides 4G and 5G open virtualized RAN (Open vRAN) software, and the Company accounts for Altiostar by the equity-method, to acquire additional shares of Altiostar and make it an indirect wholly-owned subsidiary of the Company (…) for a total evaluation of Altiostar is USD $1 billion”.

As it can be seen above, Rakuten consolidates the results of Rakuten Symphony, Rakuten Energy and Others. These 3 segments generated revenues of JPY 157bn (USD $1.08bn) and operating income of JPY 7.3bn (USD 50 million), an improvement of JPY +20.7bn since the previous year was unprofitable.

Since Rakuten Mobile is not profitable yet (but is a thriving business) and Rakuten Symphony, Energy, Others just became profitable, I have decided that I will value Rakuten Mobile segment as a mix of historical CAPEX + revalaution gain from AST SpaceMobile investment:

2018-2024 CAPEX: JPY 1.83T (USD $12.6bn)

AST SpaceMobile 2024 revaluation gain: JPY 106.9bn (USD $0.74bn)

(=) Assets: JPY 1.93T (USD $13.3bn)

Conclusion

When I started writing, Rakuten was around JPY 1.7T and is currently sitting around JPY 1.9T. This means that the current valuation of Rakuten offers an upside of roughly 2x. While there is still execution risk in term of getting Rakuten Mobile to profitability, important advancements have been made in the last years and I believe Rakuten has already reached an inflection point for this segment, marked by the profitability achieved in December 2024. Furthermore, I believe that valuing (a) Rakuten Mobile at historical cost and (b) International Business Unit at roughly 20% of the value Rakuten paid (JPY 500bn) might be leaving some value on the table, which time will set right (or not)!

(+) Rakuten Internet Services: JPY 1.47T (USD $10.2bn)

(+) Rakuten FinTech: JPY 1.72T (USD $11.9bn)

(+) Rakuten Mobile: JPY 1.93T (USD $13.3bn)

(+) Rakuten Group Non-Consolidated Cash: JPY 750bn (USD $5.2bn)

(-) Rakuten Group Non-Consolidated Debt: JPY 1.73T (USD $12.0bn)

(-) Rakuten Mobile Loans and Lease Finance: JPY 342bn (USD $2.4bn)

Excluding internal transactions of JPY 783bn (USD $5.4bn), mainly from Rakuten Group.

(-) Rakuten Mobile Lease Obligations: JPY 207bn (USD $1.4bn)

(=) Net Assets (Implied Value): JPY 3.59T (USD $24.8bn)

Disclosure: After finishing the write up, I opened a position in Rakuten.